Investing for Child's Education and Marriage: A Systematic Approach

Most parents aspire to secure their child’s future. I’ve often been approached by young parents seeking advice on which mutual funds to invest in for their child’s education and marriage. I firmly believe in adopting a systematic approach for such investments to yield optimal results. In this blog post, I’ll outline a systematic analysis to guide you through this process.

1. Identifying the Financial Goals

Let’s consider a scenario: You have a three-year-old daughter, and you wish to invest for her higher education and marriage. Your estimated current requirements are ₹20 lakhs for her higher education and ₹25 lakhs for her marriage.

| Expense | Duration | Current Amount (₹) |

|---|---|---|

| Higher Education | 15 years | 20,00,000 |

| Marriage | 20 years | 25,00,000 |

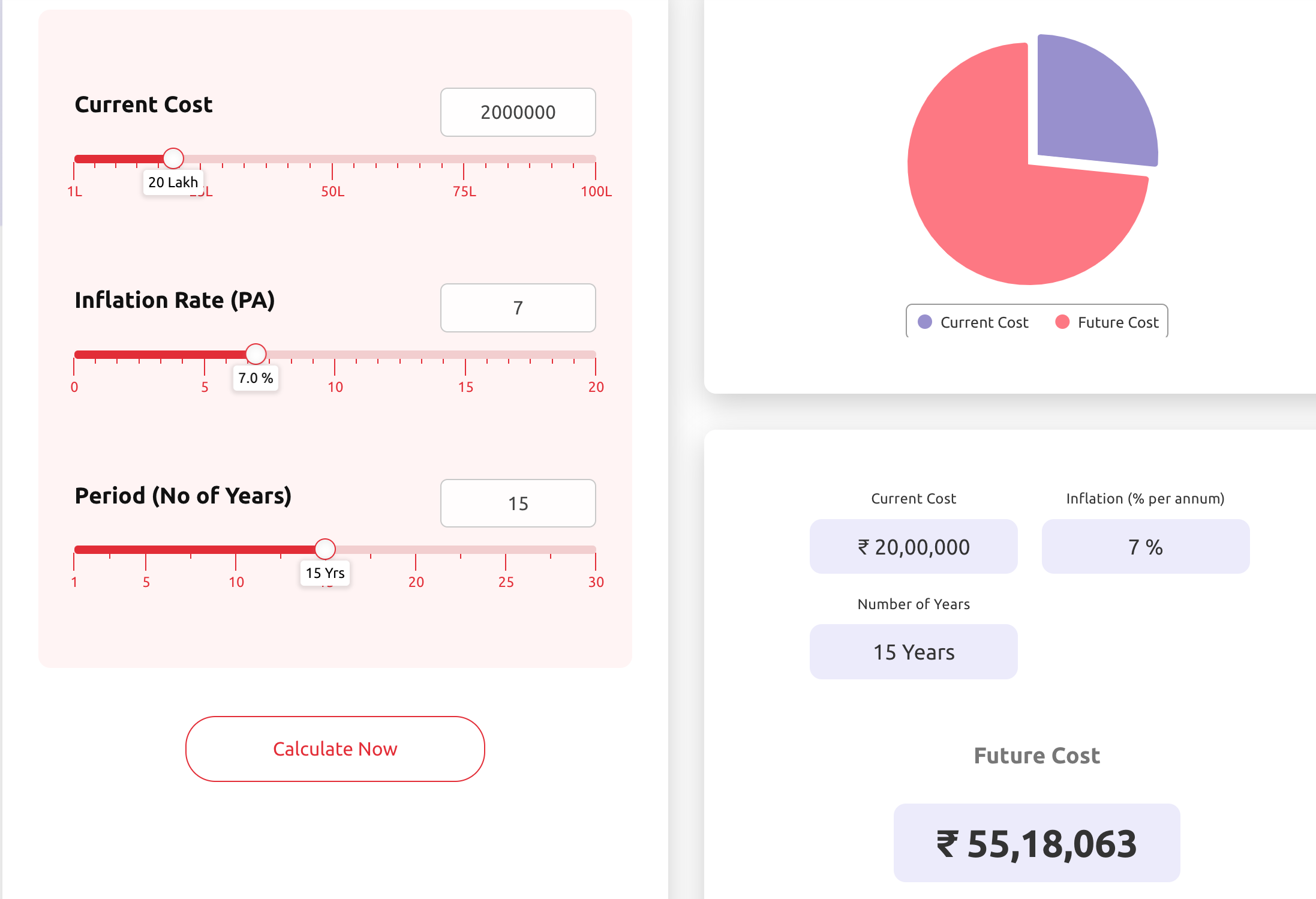

2. Calculating the Future Value

To determine the future amounts required, we utilize a future value calculator (like this one) along with reasonable inflation assumptions.

| Expense | Duration | Current Amount (₹) | Inflation | Future Amount (₹) |

|---|---|---|---|---|

| Higher Education | 15 years | 20,00,000 | 7% | 55,18,063 |

| Marriage | 20 years | 25,00,000 | 6% | 80,17,839 |

3. Selecting the Right Mutual Fund

With the required amounts determined, we proceed to select a suitable mutual fund. The level of risk you can undertake depends on your investment horizon. Since we are considering long-term investments (15 and 20 years), balanced advantage hybrid funds present a viable option. For instance, HDFC Balanced Advantage Fund boasts a commendable Compound Annual Growth Rate (CAGR) of approximately 16.31% since its inception in Feb 1994, with an impressive Asset Under Management (AUM) of around ₹80,000 crores.

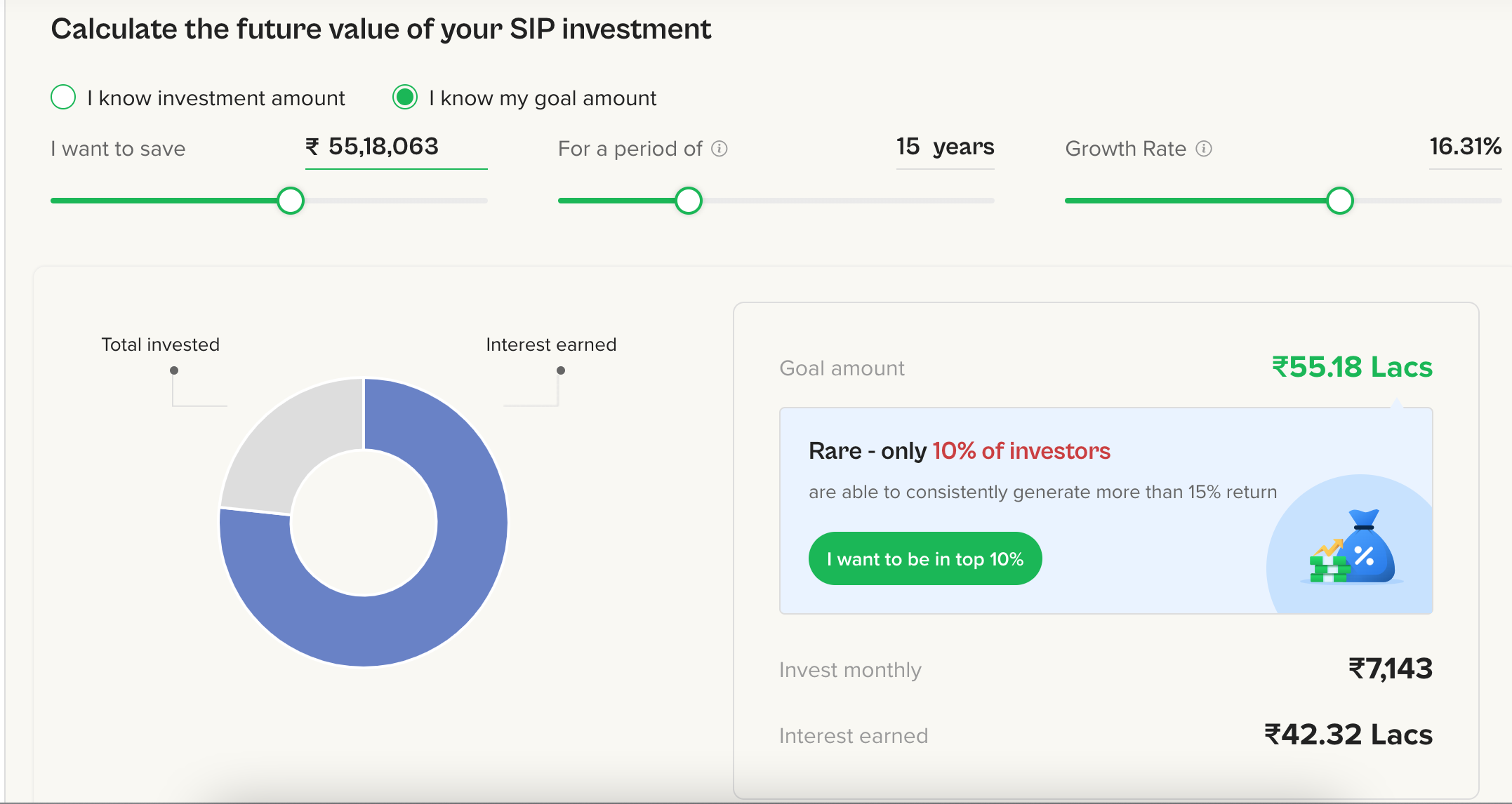

4. Calculating the Systematic Investment Plan (SIP)

Once the required amounts and expected CAGR returns are known, we calculate the monthly SIP (Systematic Investment Plan) using a SIP calculator (like this one).

| Expense | Duration | Future Amount (₹) | CAGR | SIP (₹) |

|---|---|---|---|---|

| Higher Education | 15 years | 55,18,063 | 16.31% | 7,143 |

| Marriage | 20 years | 80,17,839 | 16.31% | 4,382 |

5. Execution

Based on our calculations, investing ₹7,143 every month for 15 years and ₹4,382 every month for 20 years in HDFC Balanced Advantage Fund would help secure our daughter’s future.

Miscellaneous Considerations

- Consider obtaining a PAN card in your daughter’s name and investing through her Demat account for enhanced tax efficiency. Any taxes levied on withdrawals after 15 years will be attributed to your daughter’s income, not yours. Additionally, any profits withdrawn while you are her guardian will be added to your income.

- You may also consider increasing the SIP amount annually in proportion to the increase in your income.

- Note that the CAGR returns considered are not SIP returns but lumpsum investment returns. The SIP returns might differ but would be in line with the lumpsum returns.

- As the duration approaches, you can start shifting your portfolio from equity to debt to mitigate volatility.